- Cell Phones 641

- Editors 235

- Education, Science & Engineering 315

- Games 1627

- Internet 563

- Stock Market 12

- Web Design 100

- Scripts 358

- Miscellaneous 93

- Mobile Software 4

- Multimedia & Graphics 1134

- PC 400

- Programming 350

- Security 1479

- SEO 77

- Utilities 847

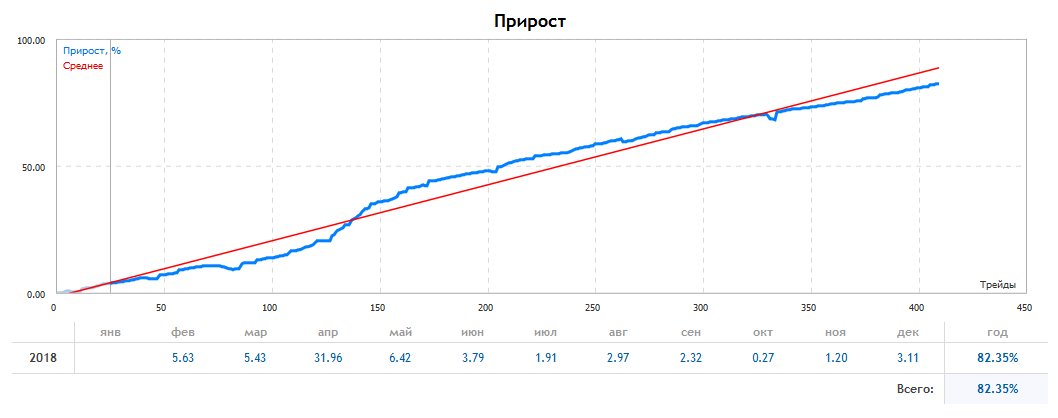

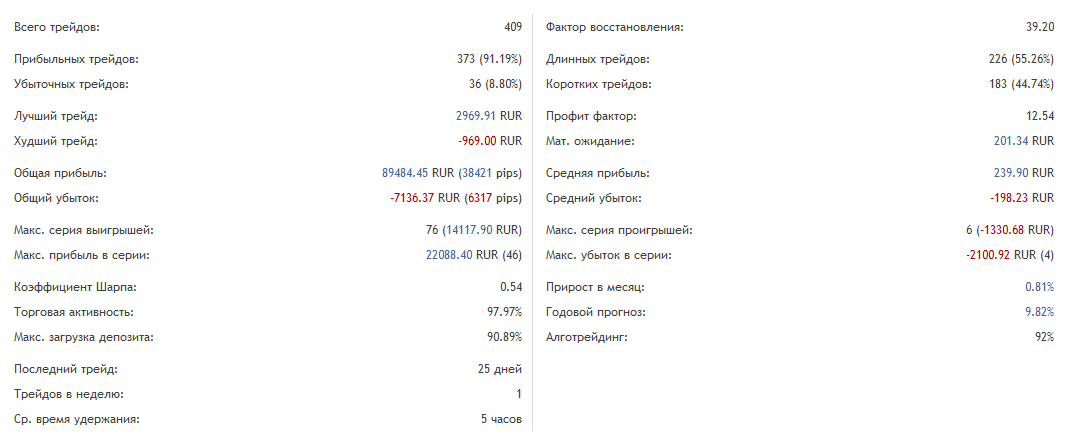

Professional trading system for the FORTS market

Content: text 32 symbols

Product description

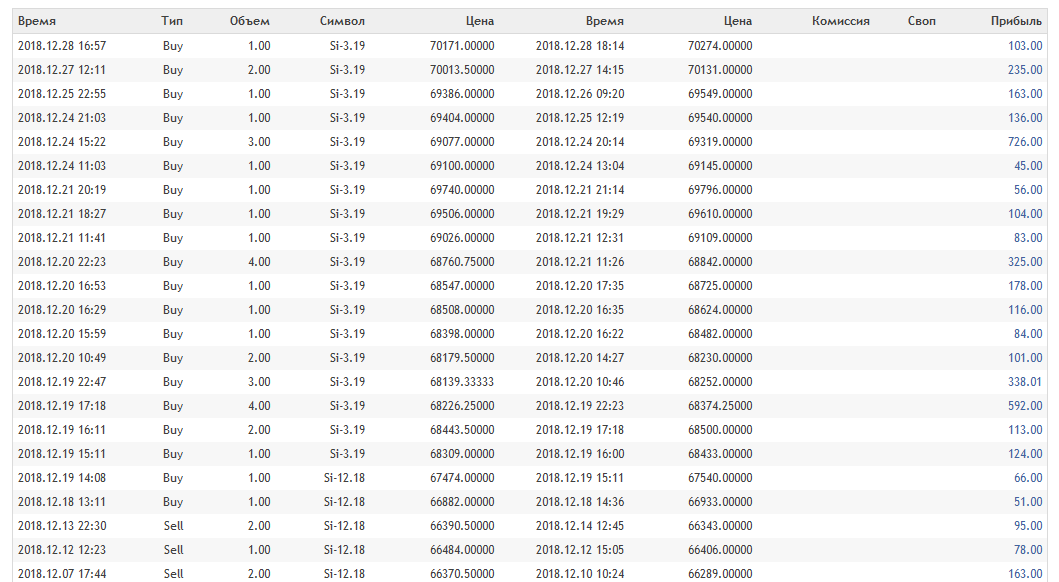

MARKET: Forts

BROKER: Discovery

TERMINAL: MT5

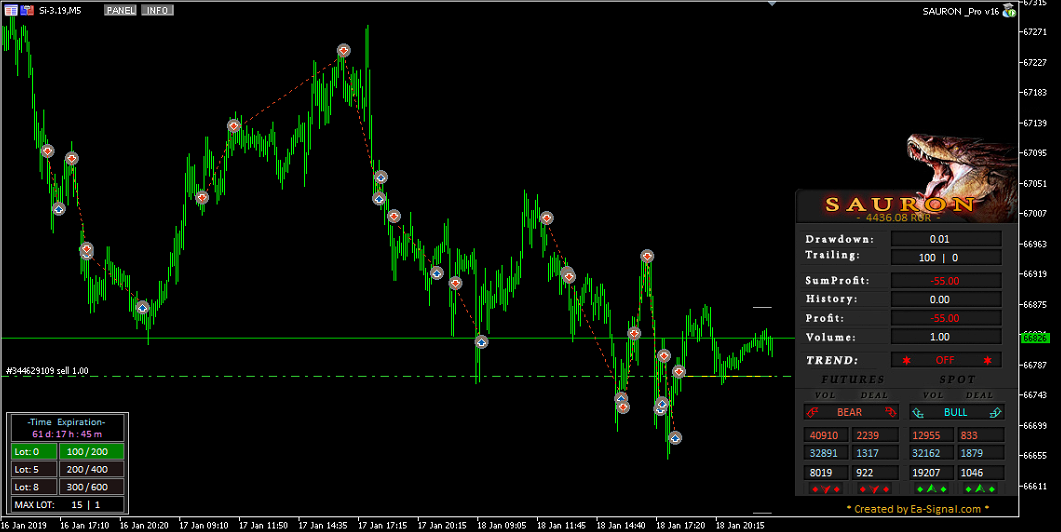

Purpose: The SAURON trading system is intended for trading on the futures and securities markets throughout the trading sessions.

Platform: The system works on the high-speed terminal Meta Trader 5 and only on those accounts where the broker in the glass provides data on supply and demand.

Recommended deposit: 100,000 rubles. for one trading instrument, whose GO does not exceed 5 thousand rubles.

Recommended trading tools:

1st Low GO - SBRF, GAZR, MIX

2nd. Secondary GO - Si, BR

3rd. High GO - RTS, MXI

Principle of operation: The SAURON trading system has 2 trading modules in one algorithm.

1: - Initially, the trading robot starts the analysis of the trading glass, on the installed tool. The glass tracks all price levels for sale and purchase, with the depth that the broker provides. The algorithm finds the density of orders at price levels, which by the set parameters are greater than or equal to the specified values. When determining the density, the tracking algorithm for the density and the change in applications in it is turned on, some testing of this density for the subject occurs - fake, rapidly replenishing and withdrawing applications, etc. The price of the found density is displayed in the graph as a graphic line with the current volume. After determining its relevance for this density, a limit order is set with a specified volume.

2: - After the request is triggered, the first algorithm is disabled and the second one is connected - the tracking algorithm. From the opening price of a position, a price channel is displayed on the chart, the distances of which are calculated according to the settings set for a wide and narrow distance from the opening price. If we assume our position in Long, then with the set parameters Narrow Grid = 100 and Wide = 200, then the upper limit of the channel is higher than the opening price, the lower boundary of the channel will be lower by 100n.

When the price leaves the price channel, below the narrow indent, the robot will top up the position with a given lot, the position will be added in the same way as the initial input, that is, the robot again starts searching for the density specified in the tracking parameters, if the flag is set to If the density were tested, then it performs these actions, if the flag is turned off, the robot immediately places a limited application under this density and performs refilling. Depending on the inclusion of testing, the density is also set, for example, if the flag is turned off, then it makes no sense to track the density of more than 10 applications, due to the fact that such applications will be far from the current price and the established limit will simply not work. Another thing is if testing is enabled, then it will be important to set a density of more than 100, so that the robot would catch a more accurate price reversal.

By analogy with a narrow range of indentation, a wide, the only difference is set up, we set a counter order for a wide one, which closes part of a position in a profit or position completely, all the same principles for finding and testing density are for setting and for wide indentation.

As soon as the order goes into profit, it is closed either on a counter limit order or through the dynamic trailing function in the account currency, the last mode sets the profit on the starting lot, if the open position becomes larger than the starting lot, the starting amount of the trail activation increases.

The robot implements all ranges of main and intermediate clearing and not large minute indents for time to avoid after the clearing price jumps ..

Feedback

0| Period | |||

| 1 month | 3 months | 12 months | |

| 0 | 0 | 0 | |

| 0 | 0 | 0 | |